The core purpose of any DAO is longevity. For a DAO to continue functioning at a high level, it needs to handle its treasury in a manner that provides longevity. This is the role of treasury management.

Protocols need to capitalize on themselves to ensure the ongoing operations for the foreseeable future and have enough funds to make investments and partnerships with others.

DAO treasuries, in some cases, are worth up to billions of dollars.

However, these treasuries are mainly filled up with a protocol's native token, which, as we will find out, is an inflated number.

Inflated Treasuries

[Figure A. October 2021]

[Figure A. October 2021]

As you can see from figure A, treasuries of these blue-chip protocols mainly consist of their native token.

A token that is considered volatile due to the speculative market will finance the operations of a DAO. It is usual for these tokens to change in value drastically, but how can you ensure the longevity of a protocol if the value of the treasury changes daily.

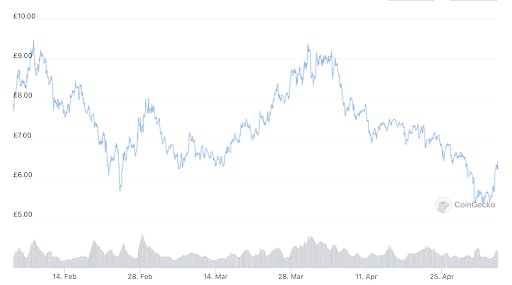

The Uniswap token has decreased by around 50% in the past three months. Due to a majority of Uniswap’s treasury being in its native token, we can assume a significant reduction in the value of the treasury.

[Figure B.]

[Figure B.]

Other protocols shared a similar fate, losing a majority of their treasury to the bear market. Looking at the treasury value on Openorg below on 5th May 2022, let’s compare it to October 2021.

[Figure C. 5th May 2022]

[Figure C. 5th May 2022]

- Uniswap had a value of $10 billion in its total treasury in October 2021

- Compound had a value of $900 million in its total treasury in October 2021

- Lido had a value of $850 million in its total treasury in October 2021

This lack of diversification is detrimental to a protocol. These blue-chip protocols in figure A have a lot of money in their treasury and can potentially stomach these changes, but it does not mean that it is effective. It is never wise to waste potential money, especially when it can be stored for a bear market.

Crypto winters (bear markets) can last around two to four years, so it is crucial to have enough money in the treasury to ensure a similar runaway length. Otherwise, protocols will see themselves going bankrupt.

Treasury management will be tackling the problems I addressed above, but how should we categorize native tokens of a protocol?

Native tokens aren’t as liquid as they seem.

Taking inspiration from Hasu’s article on DeFi treasuries, we should recognize that native tokens within a protocol could be considered as unissued shares rather than actual tokens. Hasu argues that they should be regarded as unissued shares as they are not completely liquid and can not be regarded as functional money.

This point is emphasized as Hasu explains that Uniswaps could not sell 2% of its treasuries without impacting the price of UNI by 80%. If we take this perspective, most treasuries can’t access the majority of their treasury without damaging the token value. Therefore the actual value of a treasury that is accessible is much smaller than the treasury itself.

Treasury management

Now that we understand the dangers of native tokens let’s reiterate the reason for treasury management.

- Maintain an everlasting runaway

- Diversify (Native tokens, Stablecoins, ETH/BTC, blue chips, and risky investments)

- Inflow > Outflow

As we have identified, it is impossible to maintain a runaway, solely using native tokens due to a volatile nature, so how should one diversify?

Stablecoins

Stablecoins (DAI, USDC, USDT) are the ideal place to start. Immune to the volatile nature and a more accessible currency to manage the balance sheet, DAOs can pay salaried contributors in a currency that is easy to understand.

Since stablecoins are not affected by the bear market, it means that protocols would be able to maintain or even increase their spending during a bear market. Compared to an only native token treasury, a decrease in value would significantly damage the available financial options, especially if there is a 70-90% pullback, which is typical in a bear market.

Stablecoins Management

Immediate Liquidity

This can be used for the next few months, such as salaries, grants, software expenses, etc. There should always be immediate liquidity available to cover these costs for the next 3-4 months.

Staked Stablecoins

Staking stablecoins is a great way to take advantage of idle money. There is a difference between scared money and idle money. Protocols may consider it too much effort to employ these staking tactics, but they can be very fruitful, potentially generating hundreds or thousands of dollars per day.

However, a DAO would need to identify which protocols they would use to stake their stablecoins, as there are smart contract risks that come with this. Specific protocols have been battle-tested, undergone multiple audits, and no major bugs would be seen as the most suitable. DAOs could create a set of rules that define what makes a protocol safe enough.

There are protocols like Element Finance, Curve, and Yearn that you can use for a medium-term or long-term strategy ranging from 6 months to a year. These fixed or variable APR percentages would ensure an income that could be used for operating costs.

For example, if a protocol staked 10 million USD into protocol at 4%, it would generate $400,000 per annum, which can be spent in various ways.

How to get stablecoins

Shreyas from Llama has outlined five ways DAOs can diversify into stablecoins, so I recommend reading that article.

Here is a summary:

- Earn revenue in stablecoins

- Sell native tokens for stablecoins

- Form strategic partnerships

- Borrow against native tokens

- Collaborate with stablecoin issuers

ETH/BTC and Blue-chips

These are more investment-based, but they are a great way to diversify from the native token, especially as ETH and BTC will have more minor dips than other tokens. ETH and BTC can be seen as a conservative investment in the crypto space as you are still exposed to the potential upside of gains while avoiding the volatility of holding your native token.

This approach is probably for more mature DAOs when they have built a large treasury and are looking for ways to maintain it, compared to less mature DAOs trying to build their treasury.

Another way is to build DAO to DAO partnership with blue-chip protocols and exchange native tokens for another blue-chip protocol token. In this case, Aave could exchange $AAVE for $INDEX from IndexCOOP through a partnership, that benefits both and now both protocols are exposed to another token. This increases the variety within a DAO’s portfolio and builds partnerships that can be leveraged through meta governance.

Summary

Even though it has become common knowledge that DAOs should divert a portion of their treasury into stablecoins to ensure easy accessibility at difficult times, there are no standards on how DeFi protocols should diversify their treasury.

This lack of standardization in treasury management damages protocols as they are vulnerable to various risks when managing a treasury. Identifying the best practices in treasury diversification would help protocols manage their funds more safely, thus boosting contributor and token holder confidence.